Increasing LGU revenues through Tax Mapping in the Philippines (Ref: BM-121)

Tax mapping is critical to a Local Government Unit (LGU). Tax mapping promotes transparency, enables easy access to information, and also allows fact-based decision making.

The Business Mapper team have developed a cost effective solution that does not require a large capital expenditure.

Business Mapper can integrate with most Business Permit and Licensing Systems (BPLS) and Real Property Tax Systems (RPTS).

Tax Mapping activities and the questions they answer

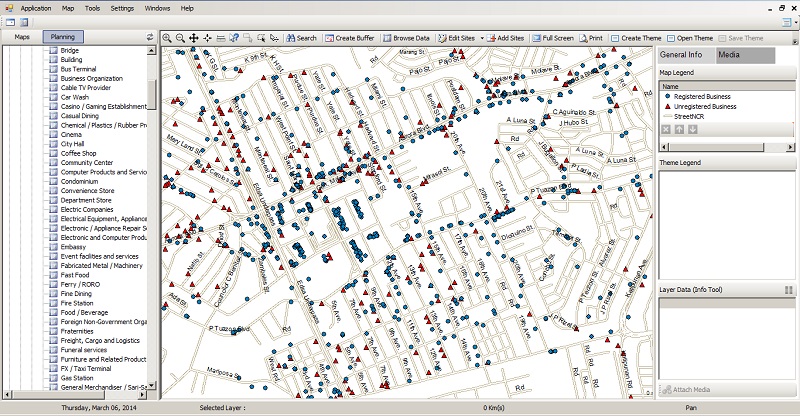

1. Map every business in your LGU. (Use existing LGU staff to survey in real time using Live Connect)

- How many businesses are in my LGU, and what types of businesses are they? What do these businesses look like?

2. Track compliance to registration.

- How many unregistered businesses are there in my LGU? Increasing compliance immediately increases revenue.

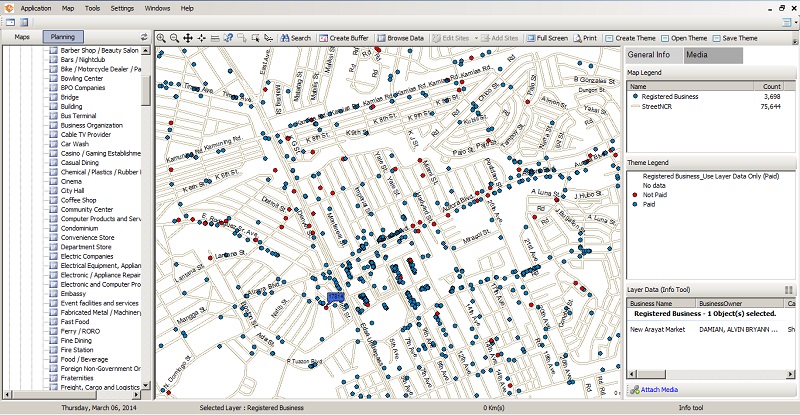

3. Track Tax Payments

- Which business establishements have not paid their taxes? where can I find them?

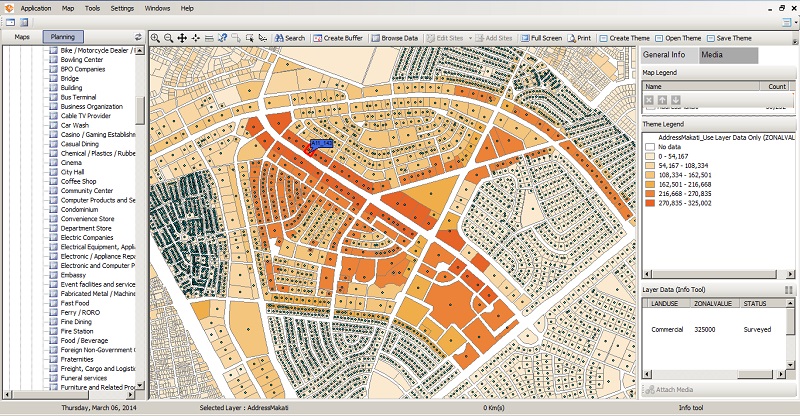

4. Map zonal values and compare

- Which areas in my LGU have high zonal values?

- How can I improve Zonal Values of some areas?

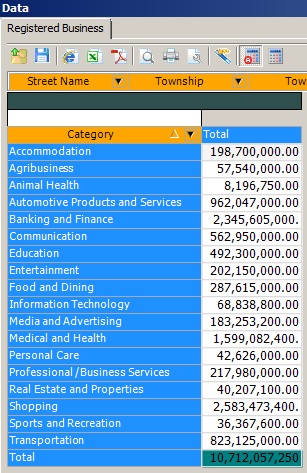

5. Advanced Tax Mapping - Forecasting Tax Revenue

- What is my expected revenue collection for the year?

Tax Mapping in Action

1. Map every business.

2. Track compliance to registration by integration with the Business Permit and Licensing System (BPLS) of choice.

3. Track Tax Payments

4. Map zonal values and track payments by integrating with Real Propert Tax Systems (RPTS).

5. Advanced Tax Mapping - Forecasting Tax Revenue

Forecast by Business Classification ( a drill down from item 5.)

Note: If this article leads to you making an inquiry to us, please use reference RE: BM-121 when you email us with your inquiry.

Business Mapper Team